Do you know the differences between Public and Private Accounting?

Keep reading to learn more about the different career fields and what you should consider for your personal career trajectory.

If you’re considering a career in accounting, you’ve come to the right place. NCW has been placing candidates in roles within the accounting & finance industry for over two years now and we’re ready to help you find your dream job. However, as many young professionals begin their career path in accounting, they often find themselves stuck choosing between public or private accounting. Ultimately we hope this blog will help you a bit in choosing what’s best for you.

Unfortunately, we can’t tell you which one to choose, but we can give you information that might help you decide what you want. In this blog you’ll see the similarities and differences between the jobs including, but not limited to, job duties, work environment, and salary. By the end we hope you’ll feel more confident in making a decision that is right for you. And once you’ve decided between public or private, come to us for the next step of your career decision-making journey. If you want to go at it on your own, you can view our available accounting & finance jobs on our website here.

What is public accounting?

Public accountants are responsible for verifying financial documents and/or reports that are required to be disclosed to the public. Public accountants work for firms that are hired as third parties by companies to evaluate their finances with an unbiased perspective that they wouldn’t be able to get internally. When you think of public accounting, think external to the firm!

What is private accounting?

Private accountants work for a sole company and only focus on finances for that company’s fiscal operations. They do not get hired as a third party to consult for other organizations. They file tax returns, perform audits and provide financial advice only for their company. When you think of private accounting, think internal to the firm! A private accountant’s work is ultimately vetted by public accountants as an extra safety measure.

Now that we have broad definitions of each position, let’s dive into the differences between the two.

Job duties

Everyday tasks of a public accountant involve analyzing the financial documents they are given (such as but not limited to balance sheets, income statements, cash flow statements, and/or statements of shareholders’ equity) and looking for errors. This, as we mentioned, is to provide outside perspective that verifies the documents without biases. This is a value add for companies as it protects them and their interests.

A private accountant is heavily involved in the day-to-day documentation that will later be reviewed by a public accountant. In simpler terms, private accountants are creating and managing all the financial records for their business on a daily basis. Typical tasks can include establishment of internal processes, working with financial managers to develop budgets, and evaluating fiscal performance. Private accountants can quickly become experts in certain fields of accounting based on the companies they work for because they wear many hats within an organization.

Work environment

No matter what type of accounting you pursue, you will fall subject to a busy season. For public accountants this takes place during tax season, which is roughly February-April every year. For private accountants, they are busiest at the end of their company’s fiscal year.

When it comes to workload, public accountants can be expected to work 40+ hours a week. Why? Because they work with a variety of clients that have different needs. Each client has different deadlines and requirements that the public accountant must prioritize in order of urgency all in one season. This usually means that the only way to meet deadlines is by extending work hours. Many public accountants must also travel to clients so they can effectively verify information. Even though the hours during tax season may be long, (typically increasing from 45-50 hours a week to 65-70 hours a week according to RBT CPAs) public accountants get exposure to a variety of different businesses, opening up their future career opportunities.

Private accountants typically work average hours (40hrs/week) with some longer days during the busy season. As mentioned earlier, private accountants become industry experts but are not exposed to a variety of different industries to grow their knowledge base.

Salary

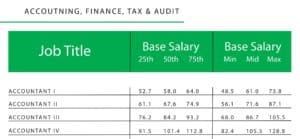

As a courtesy to our clients and candidates, NCW uses Salary.com’s Compnanalyst tool to provide accurate salary data for a variety of different positions. Below you’ll find the salary differences in thousands for roles in accounting (Ex. 52.7 is equivalent to $52,700).

*For reference, “Accountant I” would be an entry level position, and “Accountant IV” would be the most experienced position listed.*

Did you want to see salaries for other roles? Check out our 2022 Accounting & Finance and Tax & Audit Salary Guide here.

Though there are subtle differences, choosing between public and private accounting is a big choice. It’s important to take into consideration your own goals and aspirations when making your decision. Our Accounting, Finance, Tax & Audit recruiters are always available to talk through our opportunities and compare them to your personal career aspirations. But, no matter what you choose, a career in accounting will provide you with versatile skills to last throughout your career.